Ct Sales Tax On Construction Services . sales tax on construction services. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services in connecticut are generally not subject to. sales of normally taxable property or services can be exempt based on identity of the purchaser. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. in most states, construction contractors must pay sales tax when they purchase materials used in construction. In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; for example, connecticut requires contractors to pay tax on its material purchases but also collect sales.

from exomqldcd.blob.core.windows.net

sales tax on construction services. in most states, construction contractors must pay sales tax when they purchase materials used in construction. sales of normally taxable property or services can be exempt based on identity of the purchaser. for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services in connecticut are generally not subject to. In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts;

Ct Sales Tax Cal at Maria Snyder blog

Ct Sales Tax On Construction Services in most states, construction contractors must pay sales tax when they purchase materials used in construction. for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. Construction services in connecticut are generally not subject to. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; in most states, construction contractors must pay sales tax when they purchase materials used in construction. In general, every retailer of. sales of normally taxable property or services can be exempt based on identity of the purchaser. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales tax on construction services.

From talyaycynthie.pages.dev

Ct Sales Tax Due Dates 2024 Arden Brigida Ct Sales Tax On Construction Services Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; the following is a list of certain services that are subject to connecticut sales and use taxes under conn. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services in connecticut are generally not subject to. . Ct Sales Tax On Construction Services.

From www.pdffiller.com

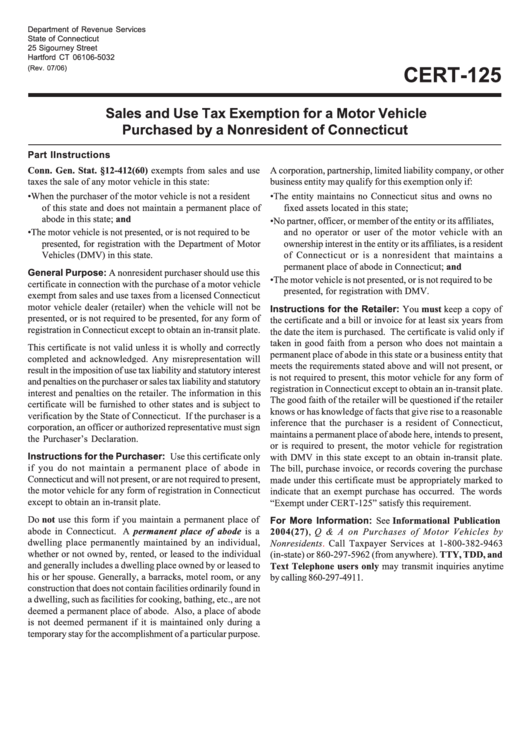

Government Tax Exempt Form Pdf Fill Online, Printable, Fillable Ct Sales Tax On Construction Services for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. Construction services in connecticut are generally not subject to. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales of normally taxable property or services can be exempt based on identity of the purchaser. Pay sales. Ct Sales Tax On Construction Services.

From howtostartanllc.com

Connecticut Sales Tax Small Business Guide TRUiC Ct Sales Tax On Construction Services the following is a list of certain services that are subject to connecticut sales and use taxes under conn. in most states, construction contractors must pay sales tax when they purchase materials used in construction. sales tax on construction services. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services. Ct Sales Tax On Construction Services.

From elaneqcassandry.pages.dev

Connecticut Taxes 2024 Bird Katleen Ct Sales Tax On Construction Services the following is a list of certain services that are subject to connecticut sales and use taxes under conn. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales of normally taxable property or services can be exempt based on identity of the purchaser. Pay sales and use tax on materials, supplies,. Ct Sales Tax On Construction Services.

From www.facebook.com

Gateway Financial, Insurance and Tax Services East Haven CT Ct Sales Tax On Construction Services Construction services in connecticut are generally not subject to. in most states, construction contractors must pay sales tax when they purchase materials used in construction. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. for example, connecticut requires contractors to pay tax on its material purchases but. Ct Sales Tax On Construction Services.

From prntbl.concejomunicipaldechinu.gov.co

Connecticut Sales And Use Tax Resale Certificate prntbl Ct Sales Tax On Construction Services Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; the following is a list of certain services that are subject to connecticut sales and use taxes under conn. in most states, construction contractors must pay sales tax when they purchase materials used in construction. In general, every retailer of. Pay sales and. Ct Sales Tax On Construction Services.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Ct Sales Tax On Construction Services In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; in most states, construction contractors must pay sales tax when they purchase materials used in construction. sales tax on construction services. the following is a list of certain services that are subject to connecticut sales and use. Ct Sales Tax On Construction Services.

From www.salestaxhelper.com

Connecticut Sales Tax Guide for Businesses Ct Sales Tax On Construction Services In general, every retailer of. sales tax on construction services. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. Construction services in connecticut are generally not subject to. sales of normally taxable property or services can be exempt based on identity of the purchaser. for example,. Ct Sales Tax On Construction Services.

From www.yumpu.com

Form OS114 Sales and Use Tax Return CT.gov Ct Sales Tax On Construction Services Construction services in connecticut are generally not subject to. the following is a list of certain services that are subject to connecticut sales and use taxes under conn. sales of normally taxable property or services can be exempt based on identity of the purchaser. in most states, construction contractors must pay sales tax when they purchase materials. Ct Sales Tax On Construction Services.

From www.templateroller.com

Form OS114 (SUT) Fill Out, Sign Online and Download Printable PDF Ct Sales Tax On Construction Services Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; In general, every retailer of. for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. Construction services in connecticut are generally not subject to. sales of normally taxable property or services can be exempt based on identity. Ct Sales Tax On Construction Services.

From exomqldcd.blob.core.windows.net

Ct Sales Tax Cal at Maria Snyder blog Ct Sales Tax On Construction Services the following is a list of certain services that are subject to connecticut sales and use taxes under conn. sales of normally taxable property or services can be exempt based on identity of the purchaser. for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. sales tax on construction services.. Ct Sales Tax On Construction Services.

From www.formsbank.com

Fillable Form Cert139 Sales And Use Tax Exemption For A Vessel Ct Sales Tax On Construction Services Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales tax on construction services. in most states, construction contractors must pay sales tax when they purchase materials used in construction. sales of normally taxable property or services can be exempt based on identity of the purchaser. the following is a. Ct Sales Tax On Construction Services.

From www.youtube.com

Newegg Will Collect CT Sales Tax What they should have done in the Ct Sales Tax On Construction Services In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; in most states, construction contractors must pay sales tax when they purchase materials used in construction. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; the following is a list of certain. Ct Sales Tax On Construction Services.

From darciazulrike.pages.dev

Ct Sales Tax Free Week 2024 Perl Trixie Ct Sales Tax On Construction Services sales of normally taxable property or services can be exempt based on identity of the purchaser. sales tax on construction services. for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. Construction services in connecticut are generally not subject to. the following is a list of certain services that are. Ct Sales Tax On Construction Services.

From cert-141-form.pdffiller.com

Cert 141 Fill Online, Printable, Fillable, Blank pdfFiller Ct Sales Tax On Construction Services for example, connecticut requires contractors to pay tax on its material purchases but also collect sales. sales of normally taxable property or services can be exempt based on identity of the purchaser. Construction services in connecticut are generally not subject to. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales. Ct Sales Tax On Construction Services.

From paulaydolores.pages.dev

Ct Sales Tax Free Week 2024 Schedule Abby Linnea Ct Sales Tax On Construction Services sales of normally taxable property or services can be exempt based on identity of the purchaser. in most states, construction contractors must pay sales tax when they purchase materials used in construction. In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; sales tax on construction services.. Ct Sales Tax On Construction Services.

From www.taxscan.in

No Service Tax on Consideration received for Construction Services Ct Sales Tax On Construction Services the following is a list of certain services that are subject to connecticut sales and use taxes under conn. sales of normally taxable property or services can be exempt based on identity of the purchaser. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services in connecticut are generally not subject. Ct Sales Tax On Construction Services.

From www.slideserve.com

PPT Connecticut Sales and Use Taxes for Construction Contractors Ct Sales Tax On Construction Services sales tax on construction services. In general, every retailer of. Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Pay sales and use tax on materials, supplies, and equipment used in their construction contracts; Construction services in connecticut are generally not subject to. the following is a list of certain services that. Ct Sales Tax On Construction Services.